Irs tax estimator 2021

2021 Returns can no longer be e-filed as of October 17 2022. Estimators This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter.

. 100 of the tax shown on your 2021 tax return. Then get Your Personal Refund Anticipation Date before you Prepare and e-File. IRS tax forms.

Curious how much you might pay in federal and state taxes this year. You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022. Use your estimate to change your tax withholding amount on Form W-4.

0 Estimates change as. Penalty Calculator Interest Calculator Deposit Penalty Calculator Tax Calculator. Check My Refund Status.

90 of the tax to be shown on your 2022 tax return or b. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Personal Finance Insiders free federal income tax calculator estimates how much you may owe the IRS or get back as a refund when you file your 2021 tax return.

Prepare and eFile from January - October following a given tax year. All taxpayers should review their federal withholding each year to make sure theyre not having. To change your tax withholding amount.

Tax Season begins in January of 2022 for 2021 Returns. Most people can use some form of IRS Form 1040 to determine how much theyll pay in. Will display the status of your refund usually on the most recent tax year refund we have on file for you.

IRS State Tax Calculator 2005 -- 2022. Plan Ahead For This Years Tax Return. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

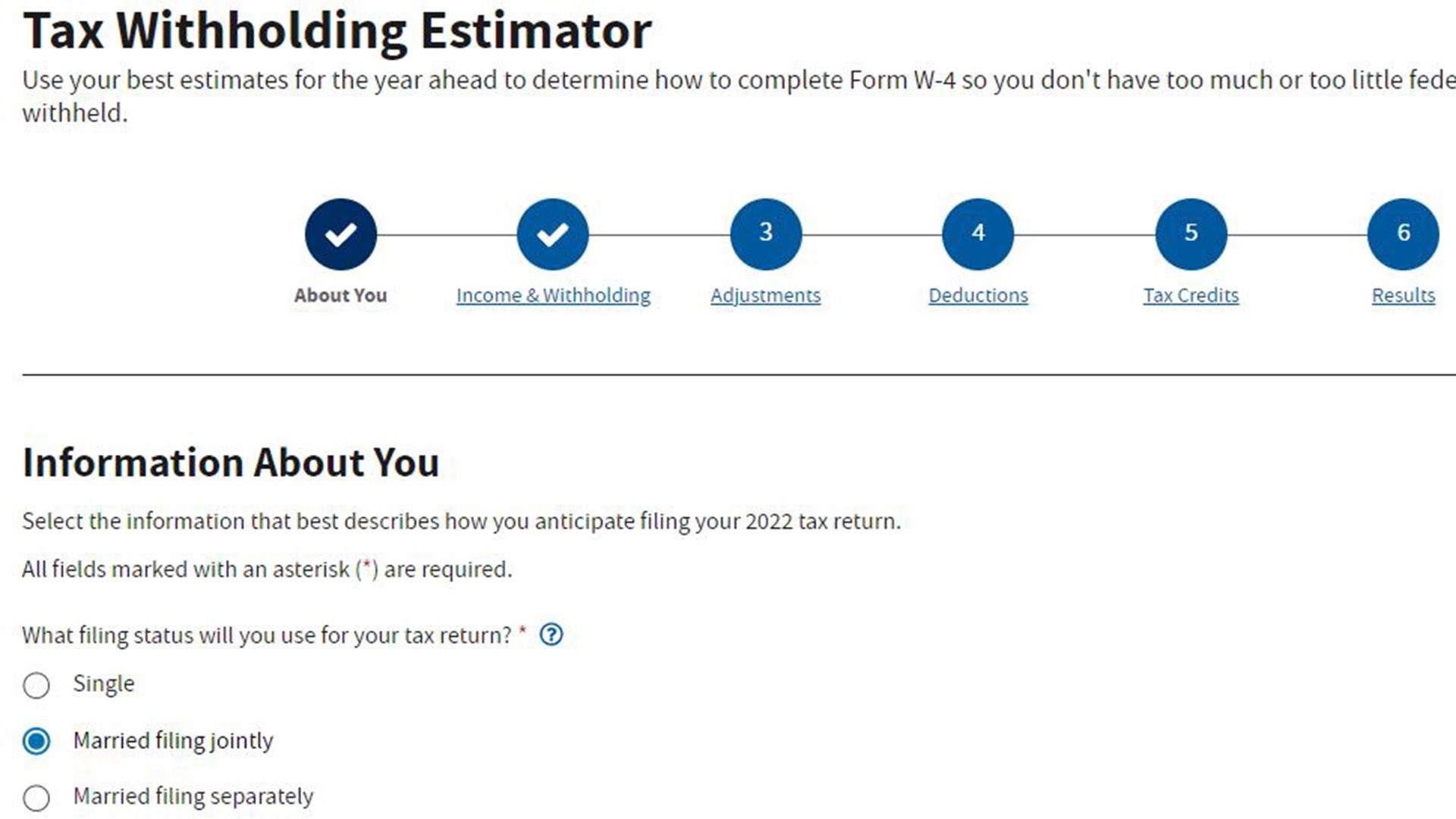

After You Use the Estimator. Set Up a Free Account. Updated for 2021 Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay.

100 of the tax shown on your 2021 return. IRS Tax Withholding Estimator helps taxpayers get their federal withholding right. You can use the eFile platform to prepare and e-file your.

Income Tax Calculator 2021. Ad Estimate Your Tax Refund w Our Tax Calculator. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Start a New 2021 Tax Return. Or keep the same amount. In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100.

If youve filed with us before just sign in to your account. Feeling good about your numbers. Take these steps to fill.

The IRS again eases Schedules K-2 and K-3 filing requirements for 2021. 66 ⅔ rather than 90 of your 2022 tax or. The calculator automatically determines whether.

For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with. Your 2021 tax return must cover all 12 months. It only takes a few seconds to set up a FreeTaxUSA account.

Personal Income Tax Calculator. Form W-4 Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct. 2021 and 2022 PTC Eligibility For tax years 2021 and 2022 the American Rescue Plan Act of 2021 ARPA temporarily expanded eligibility for the premium tax credit by eliminating the rule.

Beyond this date use the 2021 Tax Return Calculator below to estimate your return before filling in the forms online. TAXCASTER Tax Calculator 2021 Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. Estimate your tax refund with HR Blocks free income tax calculator.

Estimate Your Taxes For Free And Get Ahead On Filing Your Tax Returns Today. IRS Tax Withholding Estimator 2021 - Tax withholding estimator 2021 is a tool that helps you to estimate the amount of federal income tax withholding.

1 Uk Income Tax Calculator 2016 Salary Calculator Since 1998 Gross Salary Of 12000 2016 2016 201 Salary Calculator Income Tax Student Loan Repayment

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Form W 4 Employee S Withholding Certificate 2021 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Internal Revenue Service

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Make Your Form2290filing Easy And Secure With The Help Of The Provided Irsform2290taxfiling The Free Gross Weight Of Your Vehicle Wi Irs Forms Irs Taxes Etax

2021 Irs Tax Bracket Internal Revenue Code Simplified

New 2021 Irs Income Tax Brackets And Phaseouts

Pin On Usa Tax Code Blog

The Irs Made Me File A Paper Return Then Lost It

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

How To Keep Your 2022 Irs Tax Refund Money Now Rather Than Wait King5 Com

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Infographics Will I Owe The Irs Tax On My Stimulus Payment